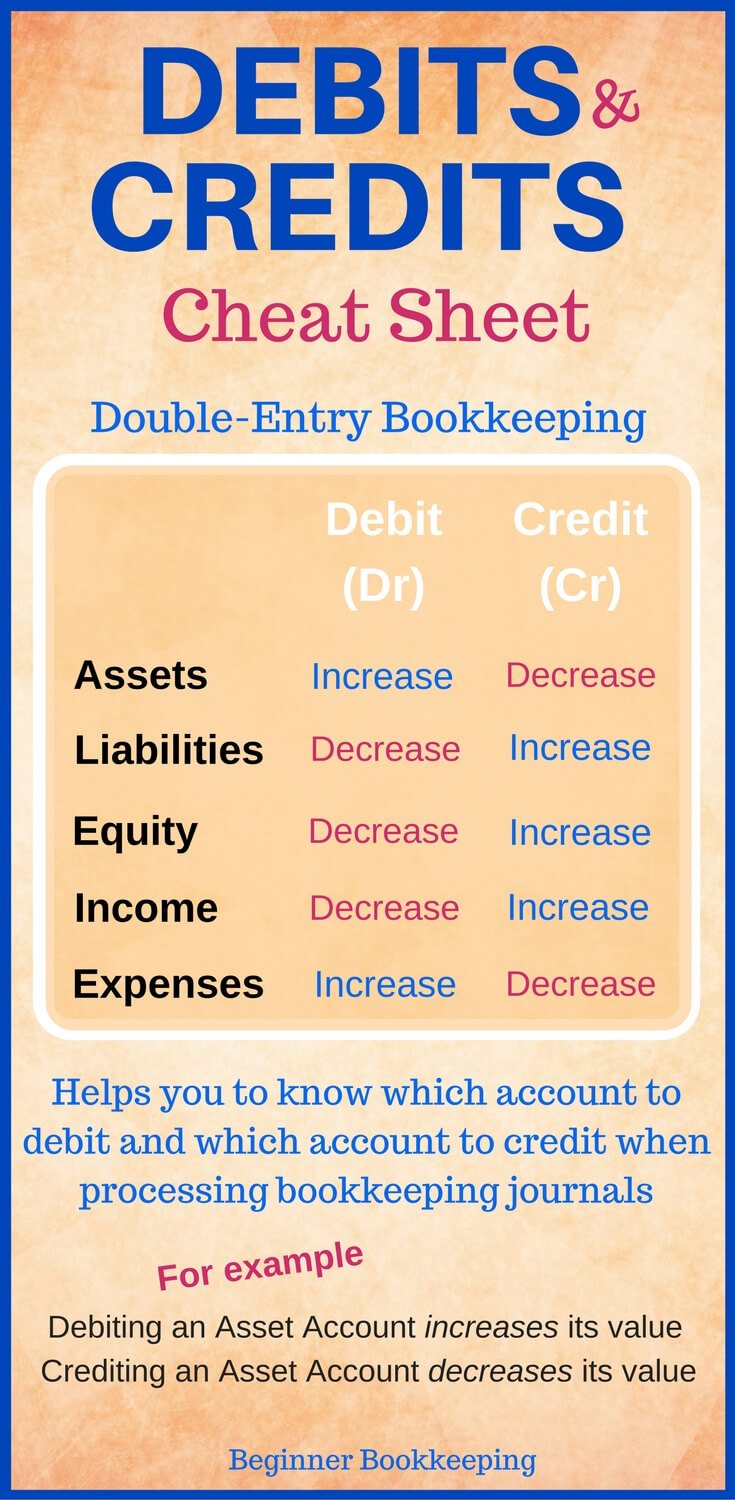

To understand debits and credits, know that debits are expenses and losses and that credits are incomes and gains. And when writing a check, the software automatically credits Cash, so you just need to select the account to receive the debit. When you enter a deposit, most software such as QuickBooks automatically debits Cash so you just need to choose which account should receive the credit. Modern accounting software helps us when it comes to Cash. If you fully understand the above, you will find it much easier to determine which accounts need to be debited and credited in your transactions. Familiarize yourself with the meaning of “debit” and “credit.” In bookkeeping, the words “debit” and “credit” have very distinct meanings and a close relationship. For example, if you pay down your Accounts Payable account with $20,000 in cash, you’ll need to adjust both accounts. Equity is what is left over after subtracting all assets, and liability is how much is owed to other parties. A sale of a product financed by the seller would be a credit to the Revenue account and a debit to the Accounts Receivable account. Office supplies is an expense account on the income statement, so you would debit it for $750.Ĭredit refers to those which makes income or gain and increases the value of something. The result of using double entry accounting ensures that every transaction is classified and recorded. The process of recording transactions with debits and credits is referred to as double entry accounting because there are always at least two accounts involved. T-accounts help both students and professionals understand accounting adjustments, which are then made with journal entries. Revenues debits and credits occur when a business sells a product or a service and receives assets.Īctual debit and credit transactions will be recorded in the general ledger, which accumulates all of the transactions, by account. They are the distribution of earnings to the owners that reduce equity. Adjusting journal entries are generally made to correct mistakes and make non-cash adjustments, such as depreciation.

When the total debits of a transaction is added to the total credits of the same transaction, the ending result should be zero. Debits are recorded on the left side of the T-accounts, while credits are recorded on the right side of the T-accounts. T-accounts are visuals that accounting professionals use to see how accounts are affected by the debits and credits of business transactions. The easiest way for accounting professionals to see the results of each transaction is to create T-accounts.

0 kommentar(er)

0 kommentar(er)